WHAT IS AFFIRM?

The lending startup Affirm enables customers to make purchases of products or services from online vendors and pay for those purchases with set monthly installments. Affirm’s lack of late fees, service fees, prepayment fees, or any other hidden fees is a perk of using them.

HOW DOES AFFIRM WORK?

The conditions of an Affirm loan vary depending on the merchant, so where you purchase with Affirm will affect your options for repayment and annual percentage rate. Among BNPL lenders, Affirm has the great bonus of never charging fees.

The simplest plan offered by Affirm, Split Pay, mimics the traditional pay-in-four arrangement typical with BNPL loans. Split Pay from Affirm allows you to make your whole purchase over four interest-free installments. The first installment is normally payable at checkout, and the subsequent three are automatically charged to the debit card, bank account, or credit card (depending on how you made the purchase) each two weeks until the loan is paid off.

For instance, if you choose Split Pay and have a $100 cart, you will pay $25 at checkout. After that, during the following six weeks, you will make the final three installments of $25 each.

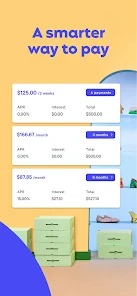

Longer payment plans, spanning from three to sixty months, are also offered through Affirm. Payments are due monthly, with the first one being due one month after your purchase is processed. These plans have APR ranges of 0% to 30%. If you don’t qualify for the whole loan amount, you might need to make an initial payment at checkout.

When you check out with Affirm, all of the repayment options will be displayed. Although you’ll have cheaper monthly payments with a longer term, you’ll pay more in interest.

Here is an illustration of how your monthly payment and interest might change depending on the most typical repayment plans offered by Affirm if you took out a $500 loan with a 15% APR.

REVIEWS AND COMMENTS OF AFFIRM

“Awesome software! Excellent method to pay for something. I’ve used Affirm a few times now, and I haven’t had any problems. It is simple to use and operates as intended. No extra costs. Before you accept, you are aware of the cost. Numerous 0% interest options, which are fantastic, have been presented to me. In certain cases, I had to pay interest. However, there is never a penalty when I pay the debt in full ahead of schedule. Wonderful company and wonderful app, especially around the holidays.” – Shana Staten

“The functioning of the app as a lending tool is quite simple. I enjoy that you may push out your next due date by months by making credit card payments in advance. Additionally, I appreciate that payments made against credit borrowed are STRAIGHTFORWARD!! Making a payment against a credit amount and then having to wait three to five business days for it to clear really irks me. Response time with Affirm is much better. I also really like using the app to manage my spending because it is so neatly organized. I suggest.” – Joaquin V

“Affirm is Arm is a fantastic tool for anyone who wants to learn how to manage credit properly because it helps users buy the products they want without accumulating excessive debt. Although the interest rate is high, the sooner you pay off the debt, the less interest you will pay. Affirm Responsibility may assist a great number of people in improving their credit scores and learning better money management techniques. I wish I had known this when I was younger because I had to learn the hard way.” – Donna Hanna