Venmo is an American cell price provider based in 2009 and owned by means of PayPal seeing that 2012. Venmo used to be aimed at buddies and household who want to cut up bills, e.g. for movies, dinner, rent, or match tickets etc. Account holders can switch cash to others by way of a cellular cellphone app; each the sender and receiver need to stay in the United States. In 2021 The business enterprise dealt with $230 billion in transactions and generated $850 million in revenue.

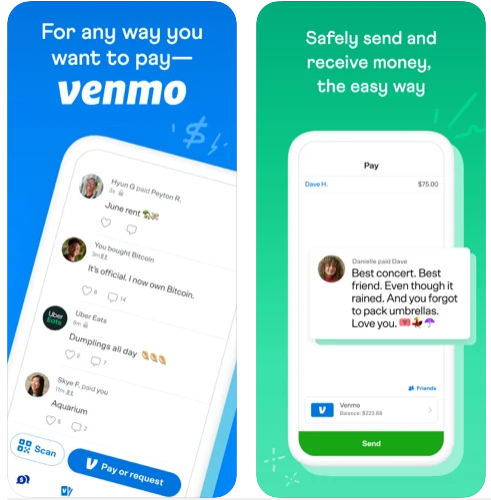

By default, Venmo publishes each peer-to-peer transaction (excluding the amount), a function proven by way of researchers to expose touchy important points about users’ lives in some situations. In 2018, the business enterprise settled with the Federal Trade Commission about numerous privateness and safety violations associated to this and different features, and made modifications to the corresponding settings. However, Venmo persevered to appeal to criticism for exposing customers to viable privateness risks.

Venmo is the fast, safe, social way to pay and get paid. Join over 83 million people who use the Venmo app today.

APP FEATURES OF VENMO

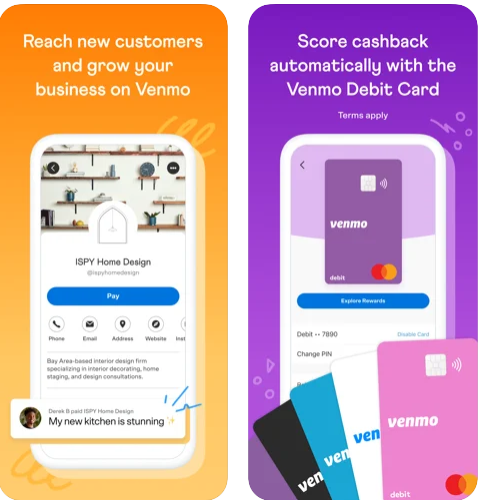

*SEND AND RECEIVE MONEY*

Receive and Send money

- Pay and receive money from everything

- Easy sending money and receive

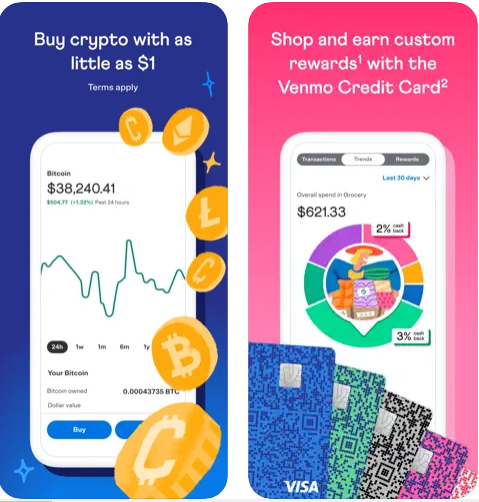

Earn credit card points from Venmo

- Cash back 3% of spending category

- Shop everything with Visa card and get money back

Pay with Venmo in stores

- Scan and Go

- Use QR codes to pay

RATING & COMMENTS OF VENMO

“I’ve been a Venmo person for a few years now and this is a finance app that does it right. I’ve cherished seeing this organisation develop and amplify their reach. It’s the best way to ship cash between friends, and with the new update, the whole lot is so without difficulty laid out inside interface! You can tell they care about their customers via how committed they are to each teaching and making budget without difficulty reachable for all. I use their savings card and it is without difficulty one of my preferred deposit playing cards I have. Your purchases are evidently laid out for you and routinely analyzed so you can see what classes you’re spending the most in. They have 3% money lower back on the class I use the most, 2% on the 2nd most used and 1% on the whole lot else? It’s a no-brainer! I can use the money that are despatched to my by means of pals to pay off my stability or I can switch these cash to the financial institution of my deciding on for free. I simply ordered their debit card. – Artie.Q”

“Venmo is the first area to definitely approve me for an unsecured savings card! Now I’ve been capable to get a couple of others! It’s exceptional easy to determine out how to use it! From sending money, receiving cash to paying for a purchase! I love how effortless it is to pay on your deposit card also! And it reviews to the savings bureaus exceptionally a lot daily! So if you cease up racking it up, make positive to pay a little on it right here and there or to at least pay the minimal due with the aid of the due date and then your rating will go up! I wouldn’t absolutely max it out although until you graph on paying on it actual soon! – Eza.A”